How to Calculate Profit on Walmart

Table of Contents

- Why Calculating Profit Is Important

- How to Calculate Profitability on Walmart

- Inventory Methods

- 1. FIFO (First In First Out)

- 2. LIFO (Last In First Out)

- 3. Weighted Average Method

- Expense Allocation

- Quick & Not So Dirty Method

- Specific Product Costs

- Admin Costs

- Other Costs to Consider

- How Sellegr8 Helps Optimize Your Walmart Profit Calculations

- Real-Time Financial Dashboards

- Advanced Order Management for Precise Profit Tracking

- Advertising Optimization for Maximizing ROI

- Listing Monitoring to Protect Your Profit Margins

- Keyword Analytics for Revenue Growth

- Taking Your Profit Calculation to the Next Level

Why Calculating Profit Is Important

If you are an experienced Walmart seller, you probably have a catalog of dozens, if not hundreds of SKUs. It is absolutely vital for you to understand your key performance indicators (KPIs). Most sellers do well to check these numbers as long as they can see them on their Walmart dashboard or inventory management software. Walmart and other software providers do their best to calculate standard metrics in standard ways, but they don't always tell you what you need to know for your specific business model.

The truth is, just understanding your margin, profit, and turnover for an inventory line on average simply isn't enough. To grow your business, you need to know the profitability of every single item you sell. No standard marketplace dashboard can give you actual profitability unless you know which exact numbers to track and analyze.

We are here to explain which numbers to take into account and how specialized tools like Sellegr8 can transform your profit calculations and optimization strategies. With proper profit tracking, you'll be able to make data-driven decisions that can significantly impact your bottom line.

How to Calculate Profitability on Walmart

In the excitement of finding a profitable product to sell on Walmart, it can be easy to lose track of how to figure out exactly HOW profitable it is. Many times as e-commerce sellers we get so caught up in sourcing a product, getting the listings written, and setting up their fulfillment, we forget all the dozens of small expenses that get incurred along the way.

Inventory Methods

Inventory allocation methods trip up almost everyone - even large corporations. Prices change from shipment to shipment - prices of the products, of shipping, even the cost of warehousing. As tempting as it is to lump all of the same SKUs together at a single cost, you can quickly lose sight of products that are no longer profitable this way. You, or your bookkeeper, need to be keeping a close eye on how many products came per shipment, and when they are sold.

In general, there are 3 ways to figure out which inventory is getting sold. It doesn't matter which method you choose, but once you pick it, you need to stay with it.

1. FIFO (First In First Out)

This method probably makes the most sense logically. When you buy several shipments over time of bottles of shampoo, it makes sense that you are selling them in the order you received them. With this method, you are always selling the oldest stock first.

With FIFO, you can calculate your profit this way: sale price minus cost of the oldest product of that type. If your first shipment had 200 bottles of shampoo, and you calculate your cost per bottle at $0.75, You need to assign a cost of $0.75 to the first 200 bottles sold. If the next shipment costs $0.73 per bottle, you still have to keep using that initial $0.75 cost until all of those first 200 bottles are gone. Then you switch to $0.73 until that second shipment is used up, and so on.

2. LIFO (Last In First Out)

The second most common inventory method is called LIFO - Last In First Out. This means that you are always selling the newest of your inventory. Large companies like to use this method for accounting when prices are going up, because it shows a smaller profit, and the company will owe less in taxes.

As an eCommerce seller, you might also want to pay attention to the costs of your most recent shipments. If they are much more expensive than the 'old' inventory, it may be time to re-evaluate whether the product is worth selling. It's always worth selling off inventory you already have (even if you have to sell at a loss), but you absolutely need to stop buying more of it!

3. Weighted Average Method

The third method of calculating the cost of your inventory is to average it. It may be tempting to think - yes! I'll just average out the cost of all those shipments and use that to figure out if my shampoo is profitable. However, it's not that easy. You still need to know exactly how many of each shipment you have left, so you can calculate a 'weighted average'.

Let's say your first shipment had 100 items at $1 each and your second had 200 at $2 each. You can't just average $1 and $2 to get $1.50. Since there are so many more items that cost $2, the average cost is actually $1.67.

Note - with all these inventory methods, it doesn't matter what items are actually sent! Unless there is a way to tell them apart (like expiration date), you don't need to worry about where the items come from. We are just concerned with making sure the right number of items get assigned the correct cost of goods.

Expense Allocation

Expenses can be easy to overlook. When you are choosing new products to carry in your Walmart store, we tend to think just about the cost of the items. This leads to disaster for your profitability!

Every single expense that can be assigned back to a product, should be! When you are figuring out profitability, go with the most 'conservative' estimate you can. This means that you count up all the expenses that you wouldn't have paid if you did not carry that product. Don't forget these:

- Shipping - getting the product to your fulfillment center

- Taxes/Fees - absolutely every cost for a shipment should be included in the expenses assigned to each item

- Prep Center costs - including the cost of getting items to the prep center and from the prep center to fulfillment

- Gas - if you are buying items retail arbitrage or any other way you need to pick them up yourself

- Hourly wages - if you hire assistants to buy, pack, or ship your items, their hourly wages absolutely need to be figured into the cost of your products. If you are doing this yourself, you should calculate an average cost of your time. After all, this job is keeping you from doing anything else.

- Sales tax - unless you are buying wholesale, you may be paying sales tax on your products. That's part of what it costs you.

- Warehousing costs - If you are paying a fulfillment center fees for keeping your merchandise, that cost needs to be included as well.

- Walmart fees - including referral fees, fulfillment fees, and any other platform charges

- Cost of returns - not every product that gets sold will actually pay. If you have a return rate of 10% (of products that can't be re-sold), that means that each of the other products you sell is actually 10% more expensive than you thought.

- Advertising costs - Your Walmart Connect ad spend directly impacts your product profitability

Quick & Not So Dirty Method

There is a lot to think about when figuring out your profit. You won't actually be able to assign all specific costs to each product, but knowing what to include in your estimates is extremely important.

Specific Product Costs

Some costs can be exactly calculated. Make sure you include all of them:

- Cost of products (average or exact)

- Shipping to fulfillment center

- Order commission cost (Walmart fees)

- Shipping to customer

- Advertising cost per product

Other costs are more general, so you will have to get an average and assign that to each inventory item.

Admin Costs

It can be tough to decide which admin costs are sales specific. You probably take courses or have a business coach. These costs are not usually assigned to your products. There are others, however, that make sense to include in the cost of a product. When in doubt, ask yourself if this cost would be different if I were selling a different product? Would this cost disappear if I stopped selling all products?

- Average cost of returns - as we said above, sometimes you have to give refunds for products that you cannot re-sell. Since you won't be making anything on that item, everything that it cost you (including shipping and Walmart fees) is actually a cost to include in all your other inventory.

- Cost of packaging - do you need to prep the item? Are you shipping it to a fulfillment center? This adds to the cost of every inventory item.

- Average unsold inventory - sometimes called obsolete inventory. These are items you are unlikely ever to sell in the future. If you buy children's clothes wholesale, the manufacturer may force you to buy some in every size, even if you know that style is unlikely to appeal to older kids in larger sizes. The clothes you must buy, but know you will never sell, should be counted against the items you know you will sell.

Other Costs to Consider

Advertising for specific products - Are you spending money advertising specific products in the hope of getting them to sell better? Those are costs you wouldn't have if you weren't selling this specific item.

Ad-to-Sales Ratio - This metric helps you understand how much of your revenue is being spent on advertising. A high ratio might indicate inefficient ad spend that's eating into your profits.

Profit After Advertising Cost (PAAC) - This crucial metric shows your true profit after accounting for all advertising expenses. It's essential for determining the real ROI of your products.

Knowing what to include, and knowing your averages is key. Most of the time, you won't be able to calculate an exact profit on each item. However, you are much more likely to make money if you are paying attention to the real costs of your inventory - not just the wholesale price.

How Sellegr8 Helps Optimize Your Walmart Profit Calculations

Tracking all these costs and calculations manually can be overwhelming. This is where specialized tools like Sellegr8 can transform your Walmart selling experience by providing comprehensive solutions for profit tracking and optimization.

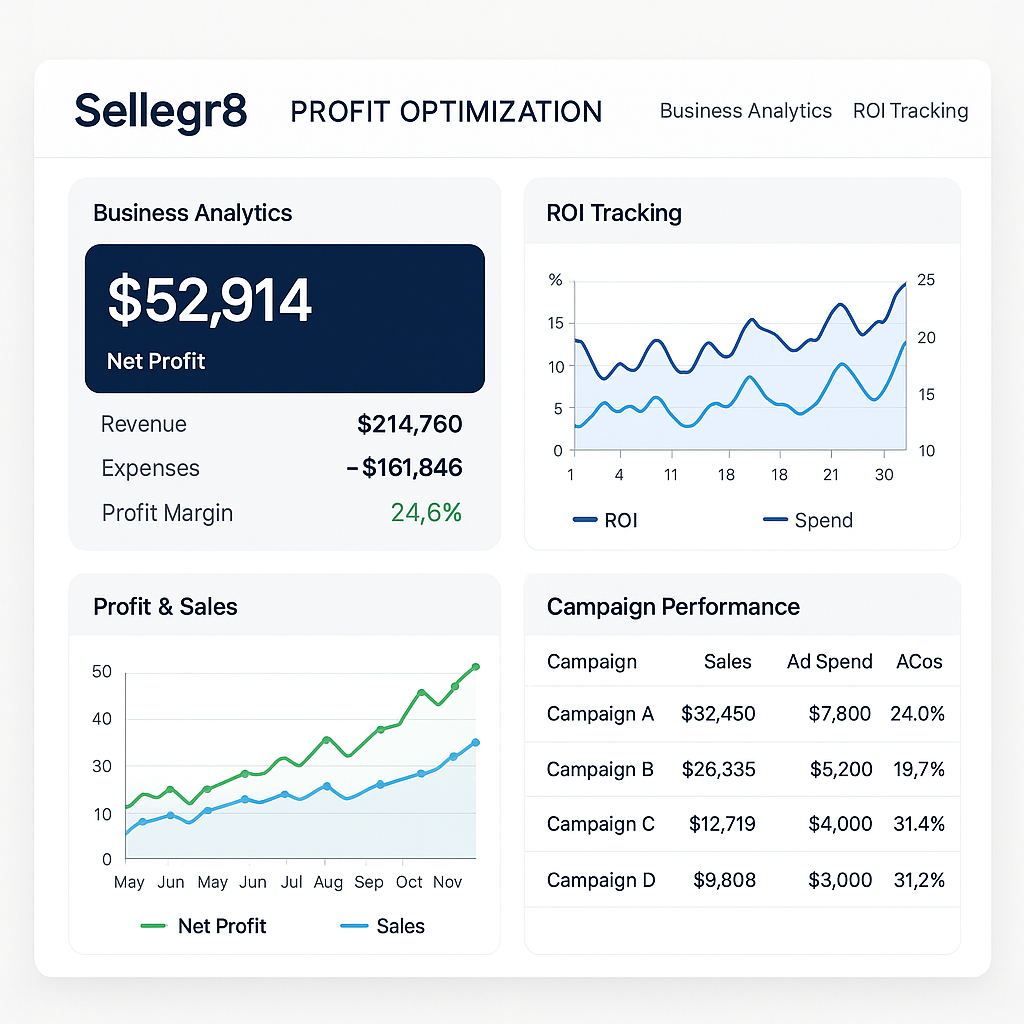

Real-Time Financial Dashboards

Sellegr8's Order Management system provides real-time financial dashboards that give you an immediate view of your key performance metrics:- Visual KPI Tracking: Easy-to-understand visual graphs showing important metrics like number of orders, items sold, and refunds

- Sales Forecasting: Predict monthly sales based on historical performance data

- Product-Level Analysis: Identify SKU-specific refund patterns and performance issues

- Profit Margin Visualization: See exactly which products are contributing most to your bottom line

Advanced Order Management for Precise Profit Tracking

Sellegr8's order management system allows you to:

- Search and Filter Orders: Quickly locate specific orders to analyze performance

- Track Customer Behavior: Understand buying patterns that impact profitability

- Export Detailed Data: Download comprehensive order information for in-depth analysis

- View Detailed Order Information: Get granular insights into every transaction

Advertising Optimization for Maximizing ROI

One of the biggest factors affecting your Walmart profitability is advertising spend. Sellegr8's Ad Campaign Management tools help you:- Track Campaign Performance: Monitor ad spend and results in real-time

- Optimize with Dayparting: Schedule ads during the most profitable times of day

- Analyze Product-Level Ad Performance: See which products deliver the best advertising ROI

- Reduce Wasted Ad Spend: Identify and eliminate underperforming campaigns

Listing Monitoring to Protect Your Profit Margins

Sellegr8's Listing Monitoring tools help you maintain optimal profit margins by:- Tracking Price Changes: Get alerts when your or competitors' prices change

- Monitoring Buy Box Status: Ensure you maintain Buy Box ownership for maximum visibility

- Tracking Reviews: Monitor customer feedback that could impact sales volume

- Detecting Listing Changes: Stay informed of any modifications to your product listings

Keyword Analytics for Revenue Growth

To maximize profits, you need to drive more traffic to your profitable products. Sellegr8's Keyword Analytics help you:- Track Keyword Rankings: Monitor how your products rank for important search terms

- Analyze Competitor Rankings: See how you stack up against the competition

- Identify Ranking Opportunities: Find new keywords to target

- Measure Advertising Impact: See how your ads affect organic rankings

Taking Your Profit Calculation to the Next Level

There is a wealth of information online to help you, even if you are brand new to the business of e-commerce. Average return rates, costs of shipping, even prep center and warehouse fees can be found online. When in doubt, OVER-estimate your expenses. You are much more likely to be profitable in the long run when you are sure that every single sale you make makes you money.By implementing a comprehensive profit calculation system using Sellegr8's suite of tools, you can:

- Identify True Profit Leaders: Know which products are actually making you money

- Eliminate Unprofitable SKUs: Stop wasting resources on items that drain your profits

- Optimize Advertising Spend: Direct your ad budget to the most profitable products

- Scale Strategically: Expand your business based on data, not guesswork

- Forecast Future Performance: Make informed inventory and business decisions

Remember, profit calculation is not a one-time activity but an ongoing process. As your business grows and evolves, so should your approach to monitoring and optimizing profitability.